Money depreciation calculator

Buses - Charter. If youre unsure of what information to enter refer to Depreciation - a guide for businesses IR260 and the General depreciation rates IR265.

Depreciation Rate Formula Examples How To Calculate

Calculate the depreciation rate ie 1useful life.

. This rate finder and calculator can only be used for assets other than buildings acquired on or after 1 April 2005 and for buildings acquired on or after 19 May 2005. On the other hand if you want to use Kelly Blue Book see the instructions that appear at the end of this post. A P 1 - R100 n.

Where A is the value of the. This decrease is measured as depreciation. To use the calculators depreciation formula on line 10 enter the total price you paid for your new or used vehicle including sales tax.

Toyotas are a safe bet new or used. If you leave the Depreciation period field empty the car depreciation calculator will output the depreciation over the next 8 years. Money Pay and Tax Calculators to calculate gross pay time card hours federal tax estimates property tax sales tax service tax in India.

Sometimes the decision to rent depends on factors other than money. If you have a question about the calculator and what it does or does not support feel free to ask it in the comment section on this page. Accumulated depreciation is the total amount of depreciation assigned to a fixed asset over its useful life.

Toyota does so impressively with three models 4Runner Tacoma and Highlander ranking in the Top 10 after 5 years. The math is a bit more complex than well want to dive into here but to get a ballpark of your expenses you can enter the cost of your property and other variables into a property depreciation. The Car Depreciation Calculator uses the following formulae.

A decrease in an assets value may be caused by a number of other factors as well such as unfavorable market conditions etc. The better approach is to expense a asset than to depreciation as the money has a time value. BMT Tax Depreciation works with your accountant to ensure that your depreciation claim for your investment property is maximised each financial year.

Toyota as a brand does very well in maintaining its value consistently ranking at the top of popular brands. The monetary value of an asset decreases over time due to use wear and tear or obsolescence. The following article will explain the.

But depreciation is an important factor in the finance. MACRS Depreciation Calculator Help. Whether you are thinking about replacing your old appliances like a washing machine or dealing with a home insurance policy that offers replacement cash value or actual cash value this calculator has got you covered.

When it comes to expense the asset it provides you with the deduction in the current. To show you how a depreciation schedule can save you money Ill be covering what a property depreciation schedule. A car that doesnt depreciate as much will save you more money than one that costs a little less to fill up and lasts longer between refuels.

Depreciation is one of the best tax breaks available to property investors but youll need a depreciation schedule in order to claim it. Input details to get depreciation. The MACRS depreciation calculator adheres to US income tax code as found in IRS Publication 946 opens in new tab.

The appliance depreciation calculator estimates the actual cash value of any home appliances that you own. To use the calculator simply enter the purchase price of the car and the age at which the car was when it was purchased by you 0 for brand new 1 for 1-year old etc. The value we get after following the above straight-line method of depreciation steps is the depreciation expense which is deducted from the income statement every year until the assets useful life.

The smart depreciation calculator that helps to calculate depreciation of an asset over a specified number of years also estimate car property depreciation. The ATO states in taxation ruling 9725 that quantity surveyors such as BMT Tax Depreciation are one of the only recognised professions with the appropriate construction costing skills to estimate. To calculate your depreciation divide your property value by 275 and you get the amount of depreciation youre allowed to claim each year.

The most common method of calculated depreciation the General Depreciation System spreads depreciation equally over a term of 275 years for residential buildings. This type of depreciation is a non-cash charge against the asset that is expensed on the income statement. For example you.

D P - A. Using the Car Depreciation calculator. Search for a suitable used car using your desired annual depreciation amount.

If you want a vehicle line that will hold its value over the long run Toyota is and has been the one to beat. Accumulated depreciation can shield a portion of a businesss income from taxes. Machinery equipment currency are.

Or calculate depreciation of any vehicle by providing its details. Multiply the depreciation rate by the cost of the asset minus the salvage cost. Above is the best source of help for the tax code.

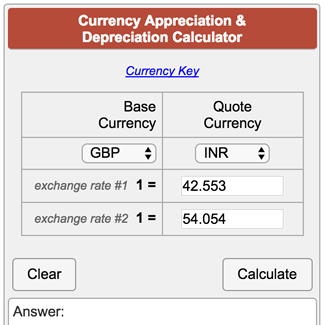

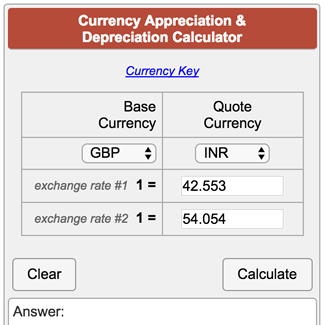

The MARCS depreciation calculator creates a depreciation schedule showing the depreciation percentage rate the depreciation expense for the year the accumulated depreciation the book value at the end of the year and the depreciation method used in calculating. Also includes currency conversion tables currency appreciation and depreciation calculators bid-ask and tip calculators. Follow the next steps to create a depreciation schedule.

Straight Line Depreciation Calculator Double Entry Bookkeeping

Depreciation Calculator Definition Formula

Depreciation Calculator Depreciation Of An Asset Car Property

Annual Depreciation Of A New Car Find The Future Value Youtube

Appreciation Depreciation Calculator Salecalc Com

Currency Appreciation And Depreciation Calculator

Depreciation Calculator

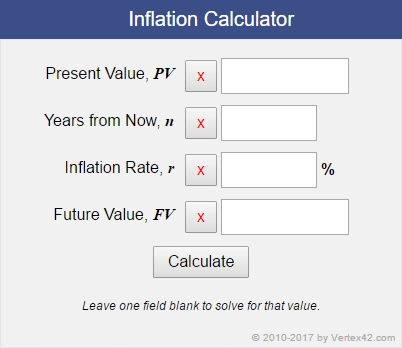

Inflation Calculator For Future Retirement Planning

Car Depreciation Calculator Calculate Depreciation Of A Car Or Other Vehicle

Appliance Depreciation Calculator

How To Calculate The Depreciation Of Currency Accounting Education

/dotdash_Final_Currency_Appreciation_Definition_Apr_2020-01-063bf4cdbc9e4f4d82fa4aa46738498d.jpg)

Currency Appreciation Definition

:max_bytes(150000):strip_icc()/dotdash_Final_Inflation_Adjusted_Return_Nov_2020-01-c53e0ae26e8f404fb1ce91a9127cbd3b.jpg)

Inflation Adjusted Return Definition

Depreciation Formula Calculate Depreciation Expense

Sum Of Years Depreciation Calculator Double Entry Bookkeeping

How To Calculate The Depreciation Of Currency Accounting Education

Reducing Balance Depreciation Calculator Double Entry Bookkeeping